Making truth powerful;

Making power truthful

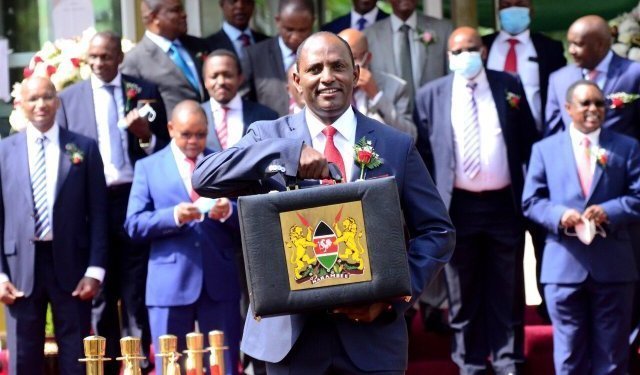

CS Ukur Yatani : Image-Courtesy

The National Treasury recently tabled the 2021/22 budget estimates alongside the Finance Bill 2021. The proposed Ksh3.6 trillion budget is a 25% increase from the Ksh2.91 trillion in 2020/21.

The budget allocates Ksh1.8 trillion to the Executive, Ksh70 billion to counties, and another Ksh37 billion and Ksh17 billion to the National Assembly and the Judiciary respectively. If approved, this will represent the biggest budget yet in the history of our republic. The budget also sets aside Ksh26.2 billion for the post Covid-19 recovery strategy economic stimulus programme.

This comes as the Kenya Revenue Authority (KRA) experiences revenue shortfalls year after year, further worsened by the pandemic. In previous years, the Kenyan government has not been able to finance its budgets, resorting to continued borrowing.

The expanded budget is surprising, considering that Kenyans are already overburdened and weary from tough economic times, occasioned by Covid-19. This, amidst concerns that the country might be unable to meet its debt obligations, considering the recent upgrade of its risk of debt distress from medium to high.

To finance the 2021/22 budget, the Finance Bill proposes various amendments aimed at widening the tax bracket. These include; amendments to the Digital Service Tax (DST), review of Value Added Tax (VAT) status for certain goods from exempt to taxable, with ordinary bread shifting from zero-rating to the standard 16% rate. These tax amendments demonstrate desperation on the side of the government to generate sufficient revenue to meet its obligations. Despite these efforts, the proposed budget still threatens to worsen the country’s debt burden.

Expanding DST’s scope to hurt online businesses

On the DST, proposed amendments aim at expanding its scope to include income accruing from businesses conducted over the internet or an electronic network, including/or through a digital marketplace. This tax rate is levied at 1.5% of the gross transaction value. Although Kenya’s digital economy is still in infancy, KRA projects collecting up to Ksh5 billion in revenue from DST in the first six months of the FY2020/ 2021.

In expanding the scope of DST, the government seeks to bring more businesses that generate income over the internet or through an electric network into the tax bracket. Since DST is being imposed on all digital services, irrespective of their gross transaction value, it could result in undesirable implications, especially for persons whose primary income is derived from provision of digital services and are under the Turnover Tax regime and minimum tax bracket. The government should consider setting a minimum threshold for applicability of DST with exemptions for businesses that register low margins. To facilitate smooth filing of DST returns, KRA should also update its online filing platform, iTax.

Description of Digital Service Tax | Source: Trio Digital Marketing

Reviewing VAT status to increase prices of basic commodities

VAT is imposed whenever a value is added on applicable goods and services across the supply chain, from production to consumption. The tax, which is levied on taxable products and services supplied or imported into Kenya, is collected by registered persons at designated points in the supply chain before submission to KRA. The registered persons charge VAT at every stage along the supply line, which the final consumer bears.

The VAT amendments are set to affect prices of basic commodities, including bread and baby-infant milk, whose prices are set to rise on imposition of 16% VAT, from current zero-rated status. Since bread is consumed in many households, this will make it less affordable to the common mwananchi, coming only months after a Ksh5 price hike, following a surge in global wheat prices. This has led to an outcry, with Kenyans terming the amendment as unfair and uncalled for, considering the economic downturn caused by the pandemic. The Bakers Association of Kenya has warned that introducing 16% VAT on bread violates the fundamental right to affordable food, besides risking closure of some companies, that could in turn see up to 100000 people jobless.

Kenyans shopping at a Supermarket | Source: Kenyan.co.ke

Similarly, removal of baby infant milk, otherwise known as formula milk, from the tax-exempt bracket will increase its price, thus affecting families dependent on it. Other commodities such as eggs, milk and meat are also set to cost more due to the proposed taxation of inputs for producing animal feeds. This will affect both farmers and consumers, as production costs will rise, translating into prices of these goods shooting up.

However, as much as the VAT amendments propose imposition of 16% tax on some items that were previously exempted, it also offers reprieve for some items by withdrawing the standard charge. The proposition to exclude the VAT levy on medical ventilators and inputs for manufacture of medical ventilators is laudable, since it encourages local innovations such as the one by students of Kenyatta University who designed and built a low-cost ventilator using locally sourced materials. With the exemption on materials for manufacturing ventilators, costs of procuring such inputs will drop. This is likely to encourage local production and reduce costs of ventilators and other related products, thus propping up management of Covid-19 in the country. Other items that have been excluded from VAT include: Insulin, Malaria test diagnostic kits, immunological products, Vitamin C and its derivatives, food supplements, protein concentrates, medical equipment and products, among others. The exemption will lower treatment costs for various ailments including diabetes, providing a relief to the health sector.

In this way, the VAT amendments signal a more considerate Treasury, especially towards the health sector. However, some discrepancies exist in the proposed policies. Some items which were exempted from the tax in the past are to be charged at a rate of 16%. For example, syringes, which complement immunological products, vaccines and treatment, will be VAT-able. The result is cancellation of the effect of exempting some of the goods. In essence, what one hand giveth the other taketh away.

With the ongoing pandemic, one would expect the government to limit its expenditures and channel more efforts and resources towards vaccinating the population as a means of jumpstarting the economy. But if the proposed budget is anything to go by, there remains little to be optimistic about. With the proposed tax amendments, the huge public debt, and runaway corruption, Kenyans should brace for tough economic times as much of the expenditure burdens shifts to their shoulders.

However, following these proposed amendments, Kenyans raised concern and were given the opportunity to submit their opinion physically at Parliament Buildings or via email to the clerk by 2nd June 2021. The President is expected to assent to the legislation by June 30th 2021, paving way for KRA to start implementing them from July 1st 2021.

Ends…

By Eunice Wahito, Emmanuel Owuor and Janet Muchai

The writers are Graduate Interns at Africa Center for People, Institutions and Societies (Acepis).